Invoice financing for SMEs offers a lifeline to small and medium enterprises, enabling them to unlock cash tied up in unpaid invoices. This financial solution helps businesses maintain liquidity and seize growth opportunities without the lengthy wait for customer payments.

By understanding the various types of invoice financing available, as well as the benefits and potential risks, SMEs can strategically leverage this tool to enhance their financial management and marketing initiatives. From improving cash flow to strengthening branding, invoice financing can be a game-changer in today’s competitive market.

Understanding Invoice Financing for SMEs

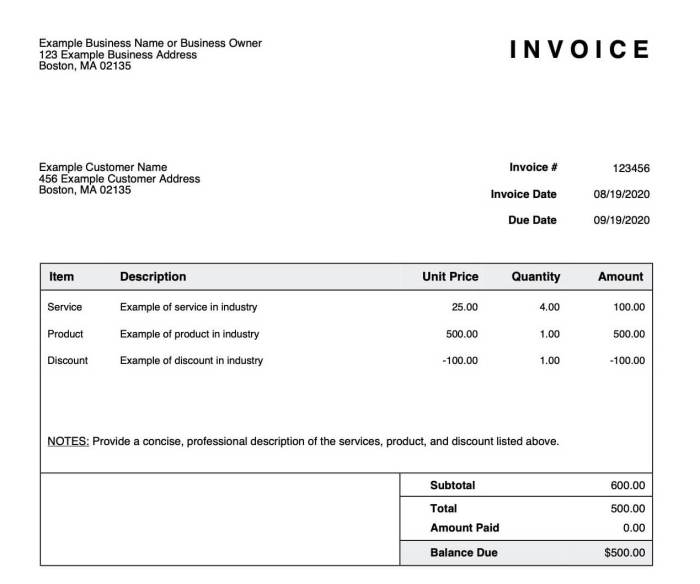

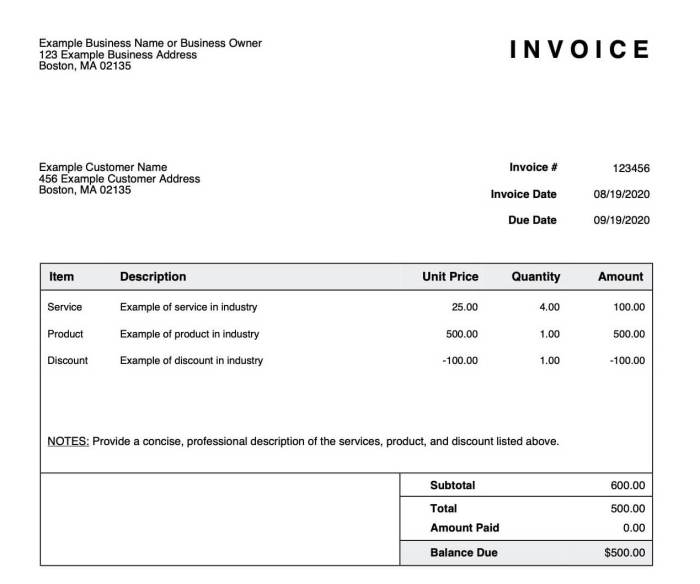

Invoice financing serves as a financial tool that allows small and medium enterprises (SMEs) to unlock the cash tied up in their outstanding invoices. This approach is significant for SMEs as it provides immediate funds to manage operational costs, invest in growth, or navigate cash flow challenges without incurring additional debt. By leveraging their invoices, businesses can maintain liquidity and avoid disruptions in their operations.Invoice financing primarily involves two types: factoring and invoice discounting.

Factoring entails selling invoices to a third-party factor at a discount in exchange for immediate cash, while the factor then takes over the responsibility of collecting payments. Invoice discounting, on the other hand, allows businesses to borrow money against their unpaid invoices while retaining control over their collections. Both methods offer distinct advantages to SMEs looking for flexible financing options to alleviate cash flow bottlenecks.

Types of Invoice Financing

Understanding the types of invoice financing is crucial for SMEs to choose the best fit for their financial needs. These financing options can be classified as follows:

- Factoring: This involves selling invoices outright to a factoring company. The business receives a percentage of the invoice amount immediately and the factor collects payment directly from customers. This option is beneficial for companies that prefer immediate cash flow and do not mind relinquishing control over the collection process.

- Invoice Discounting: With this option, SMEs can borrow money against their outstanding invoices while maintaining control over customer relationships. This is ideal for businesses that want to keep their financing arrangements discreet and continue managing customer collections.

- Spot Factoring: This variation allows businesses to sell individual invoices as needed rather than all outstanding invoices. This flexibility can be advantageous for companies with sporadic cash flow needs.

Benefits of Invoice Financing

Invoice financing provides several benefits that can enhance the financial health of SMEs:

- Improved Cash Flow: Immediate access to funds enables businesses to cover operational expenses or invest in opportunities without waiting for customers to pay their invoices.

- Flexibility: SMEs can choose which invoices to finance, allowing them to tailor their financial strategies based on current needs.

- No Additional Debt: Unlike traditional loans, invoice financing does not increase debt on the balance sheet, as it is based on the company’s existing invoices.

Risks of Invoice Financing

While there are several advantages, it is important for SMEs to also consider the potential risks associated with invoice financing:

- Cost of Financing: The fees associated with factoring or discounting can be higher compared to traditional financing options, which may affect overall profitability.

- Dependency on Customers: The success of invoice financing is reliant on the creditworthiness of the customer base. If customers delay payments, it could create a ripple effect on cash flow.

- Impact on Customer Relationships: In factoring agreements, the responsibility for collections transfers to the factor, which may alter how customers perceive the business.

Invoice financing can be a double-edged sword; while it provides immediate liquidity, companies must weigh the costs and impacts on customer management.

Branding and Marketing Strategies for SMEs Utilizing Invoice Financing

For small and medium-sized enterprises (SMEs), effective branding and marketing strategies are essential for growth and sustainability. Invoice financing can play a significant role in these strategies by providing the necessary cash flow to fuel marketing initiatives and enhance brand visibility. By understanding how to leverage invoice financing, SMEs can create impactful campaigns that resonate with their target audience while also optimizing their financial management.Invoice financing not only aids in managing cash flow but also opens up opportunities for SMEs to invest in their branding and marketing efforts.

By utilizing the capital obtained through invoice financing, businesses can undertake various initiatives that boost their market presence and enhance customer engagement.

Leveraging Invoice Financing in Marketing Campaigns

Incorporating invoice financing into marketing campaigns allows SMEs to maintain momentum and presence in their industry. Here are several strategies to effectively leverage invoice financing:

- Boosting Advertising Budgets: Invoice financing can provide immediate funds to increase advertising budgets, allowing for targeted campaigns across various platforms such as social media, Google Ads, or traditional media.

- Launching New Products: SMEs can use available cash flow to launch new product lines or services, ensuring they have the necessary resources for marketing and promotional activities that accompany the launch.

- Enhancing Customer Outreach: With additional funding, businesses can invest in CRM systems or marketing automation tools to improve customer outreach and retention strategies.

- Participating in Trade Shows and Events: Invoice financing can cover the costs associated with attending industry events, which can be vital for networking and increasing brand visibility.

Successful Branding Initiatives Incorporating Invoice Financing

Several SMEs have successfully integrated invoice financing into their branding initiatives, showcasing the potential of this financial tool. For instance:

1. A Local Food Startup

This company utilized invoice financing to fund a high-impact marketing campaign around a local food festival. By covering advertising costs, they increased their reach and gained substantial customer engagement, resulting in a notable increase in sales and brand awareness.

2. An E-commerce Retailer

An online retailer leveraged invoice financing to launch a seasonal promotional campaign that included discounts and social media advertisements. The funding allowed them to maintain a competitive edge during peak shopping periods, resulting in increased sales and strong brand loyalty.

3. A Tech Service Provider

This business invested in a content marketing strategy funded by invoice financing, allowing them to produce high-quality articles and videos that positioned them as thought leaders in their niche. This initiative not only boosted their online presence but also attracted new clients.

Enhancing Online Presence through Invoice Financing

Invoice financing can significantly enhance an SME’s online presence in various ways. By freeing up cash flow, businesses can focus on digital marketing strategies that expand their reach and improve engagement. Key methods include:

- Website Optimization: Allocating funds for website improvements can enhance user experience, ensuring faster load times and mobile compatibility, which are critical for retaining visitors.

- Investments: Investing in search engine optimization () will help SMEs rank better in search results, increasing organic traffic and brand visibility online.

- Social Media Advertising: With extra cash flow, businesses can run effective social media campaigns that target specific audiences, fostering engagement and brand loyalty.

- Content Creation: Quality content is vital for online presence; thus, securing funds to produce engaging blogs, videos, or infographics can attract and retain customers.

By strategically utilizing invoice financing, SMEs not only manage their cash flow efficiently but also enhance their branding and marketing efforts, leading to sustained growth and increased market presence.

Financial Management Practices Related to Invoice Financing

Managing cash flow effectively is crucial for small and medium-sized enterprises (SMEs) to thrive, especially in today’s fast-paced business environment. Invoice financing can provide the much-needed liquidity for SMEs, allowing them to unlock working capital tied up in outstanding invoices. This section delves into best practices for leveraging invoice financing, integrating it into business accounting systems, and utilizing it for growth and expansion initiatives.

Best Practices for Managing Cash Flow with Invoice Financing

Implementing invoice financing comes with its own set of best practices that can significantly enhance cash flow management. These practices ensure that SMEs can maintain a healthy financial position while maximizing the benefits of financing.

- Monitor Payment Terms: Establish clear payment terms with clients to expedite invoice payments. This practice reduces the time invoices remain outstanding, thereby improving cash flow.

- Choose the Right Financing Partner: Work with a reputable invoice financing provider that offers competitive rates and flexible terms tailored to your business needs.

- Evaluate Cash Flow Regularly: Keep track of cash flow through regular financial reviews and forecasts. This helps in anticipating cash shortages and planning for financing needs accordingly.

- Incorporate Invoice Financing into Sales Strategy: Use invoice financing as a tool to extend payment terms for customers while managing cash flow effectively. This could attract new clients who prefer longer payment periods.

Integration of Invoice Financing into Existing Business Accounting Systems

Incorporating invoice financing into your existing accounting framework is vital for seamless financial management. Proper integration ensures that all transactions are accurately recorded and financial reporting remains transparent.

- Utilize Accounting Software: Leverage accounting software that supports invoice financing integration. These systems can automatically update accounts receivable and cash flow reports, providing real-time insights.

- Establish Clear Protocols: Develop protocols for handling invoices that are financed, including how to update records and manage repayments to the financing provider.

- Train Accounting Staff: Ensure that your accounting team is well-trained on how to manage invoice financing transactions. This knowledge is crucial for accurate financial reporting and compliance.

- Regular Reconciliation: Perform regular reconciliations of financed invoices to ensure accuracy in financial records, preventing discrepancies that could affect cash flow management.

Guide for SMEs on Using Invoice Financing to Fund Business Development and Expansion

Invoice financing can play a pivotal role in funding business development and expansion strategies for SMEs. Leveraging this financing option wisely can create opportunities for growth and increased market presence.

- Identify Growth Opportunities: Assess potential areas for development, such as new product lines, market expansion, or technology upgrades, and calculate the funding needed for each initiative.

- Create a Strategic Plan: Develop a comprehensive business plan outlining how invoice financing will be utilized for growth initiatives, including projected timelines and expected outcomes.

- Communicate with Stakeholders: Keep all stakeholders informed about the financing strategy and how it ties into broader business objectives. This transparency fosters trust and support.

- Measure and Report Outcomes: After utilizing invoice financing for growth, measure the results against your initial projections. Regular reporting helps in refining future financing strategies and demonstrates success to stakeholders.

Final Thoughts

In conclusion, invoice financing for SMEs not only addresses immediate cash flow challenges but also facilitates growth and operational efficiency. By integrating invoice financing into their financial practices, businesses can gain the flexibility to invest in opportunities and improve their market presence, ultimately driving success and sustainability in their ventures.

FAQ Explained

What is invoice financing?

Invoice financing is a financial arrangement that allows businesses to receive immediate cash against their outstanding invoices, improving liquidity.

Who can benefit from invoice financing?

Small and medium enterprises (SMEs) that face cash flow challenges and have outstanding invoices can benefit greatly from invoice financing.

What are the risks associated with invoice financing?

Potential risks include reliance on this financing method which might lead to higher costs, and the possibility of affecting customer relationships if not managed properly.

How does invoice financing impact business credit?

Invoice financing can help maintain or improve cash flow without adding debt, potentially benefiting a business’s credit profile as long as it is managed responsibly.

Is invoice financing a long-term solution?

While it can be a valuable short-term solution for cash flow issues, relying on invoice financing for the long term may indicate underlying financial challenges that need addressing.